Ensure accurate tax compliance with SAP OneSource, streamlining tax calculations, reporting, and regulatory adherence for seamless business operations.

Access your tax compliance tools anywhere, anytime, with SAP OneSource Cloud. No more worries about maintaining or installing software. Manage taxes effectively with LMTEQ’s assisted services in SAP OneSource. Ensure compliance with the most recent tax rules and stay ahead of the game with real-time updates.

Take your tax management to higher levels. LMTEQ enables you to extract your company’s most advantageous SAP OneSource features. Experience cutting-edge technology, such as auto-scaling, self-healing, and updates, with minimal downtime, enabling you to access your solution from any location at any time.

The Determination module of SAP OneSource solutions provides the industry’s most significant coverage of product taxability. With customized taxability rules designed uniquely for business, you can safely implement the correct tax treatment for indirect taxes worldwide. Ensure compliance in all jurisdictions while staying on top of evolving tax legislation.

The Tax Service Integration for SAP S/4HANA (Global) from SAP OneSource gives you unmatched liberty. Add data for assessment and worldwide indirect tax computations easily and solve complex tax problems quickly. Whether it be GST, VAT, or other taxes, the solution offers you the flexibility and power you need to successfully negotiate the complex world of taxes.

To effectively compute taxes and prevent fines, lean on the automated determination engine of SAP OneSource. The powerful tax engine executes precise tax computations to ensure compliance and reduce the likelihood of excessive penalties.

SAP OneSource cloud solution uses cutting-edge cloud-native technology to provide a seamless experience for your tax administration needs. Enjoy features such as self-healing, zero downtime, and auto-scaling for updates. With the solution, you can easily remain on top of tax compliance anytime and from any location.

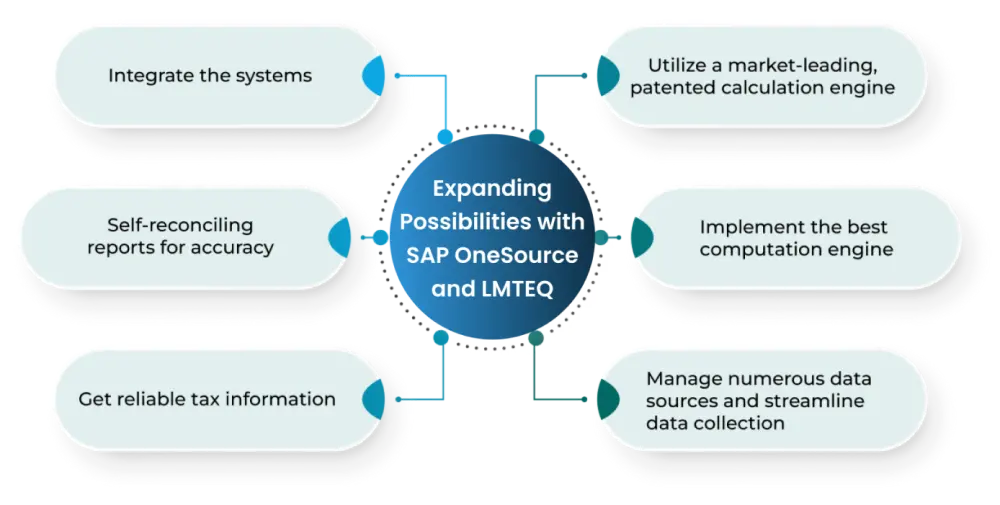

LMTEQ is an expert in smoothly integrating SAP OneSource solutions with your current systems, guaranteeing a successful deployment. Our specialists collaborate closely with your team to achieve a flawless connection that optimizes SAP OneSource’s advantages for your company.

LMTEQ leverages SAP OneSource’s market-leading, patented calculation engine to ensure accurate and reliable tax calculations for your business. Benefit from advanced algorithms that handle complex tax scenarios with precision and efficiency.

In SAP OneSource, LMTEQ also focuses on setting up self-reconciling reports. This allows you to prepare accurate tax reports, saving time and guaranteeing that you’re quickly and easily conforming with tax authorities.

To provide precise and dependable tax computations for your company, LMTEQ takes advantage of the market-leading, proprietary calculation engine from SAP OneSource. Get benefits from cutting-edge algorithms that handle complicated tax circumstances with accuracy and efficiency.

Acquire reliable tax content for SAP OneSource implementation with LMTEQ. With our experience and access to the most recent tax legislation, you can be confident that your tax computations are based on reliable and up-to-date data.

By centralizing and managing various data sources inside SAP OneSource, LMTEQ assists you in facilitating data acquisition. Put the data in order and save the effort of manual data entry. Our professionals will simplify your data management procedure with SAP OneSource solutions.

Streamline the tax compliance process by seamlessly integrating SAP OneSource with your current systems. Ensure proper tax treatment across countries while streamlining tax calculations.

To utilize SAP OneSource to its potential for your company, contact LMTEQ immediately. Experience the strength of LMTEQ’s association with SAP OneSource. Take charge of your taxes right away.