Embarking on a mission to enhance the finance operation and provide seamless payment and user experience for its global workforce, our Fortune 500 client has joined hands with the LMTEQ team. This case study delves into the details of integrating SAP S/4HANA and the OneSource Indirect Tax Engine (OITD) suite, shedding light on the complexities involved, the challenges overcome by our team, and the measurable metrics derived from the successful integration process.

The core goal for our client was to create a smooth payment process and a uniform user interface, particularly for global employees on project-related travels. With LMTEQ’s expert support, our client opted for the SAP S/4HANA and OITD suite to enhance internal financial operations. This initiative aimed at strengthening capabilities in essential business functions, such as indirect tax, employee payroll, and other financial processes.

Meeting diverse indirect taxation needs for legal and fiscal requirements.

Handling varied indirect tax requirements for Accounts Payable (AP) and Accounts Receivable (AR) transactions.

Catering to different taxation types such as GST, VAT, Sales, and Use tax.

Demanding flexibility in tax rates based on the ship-to location.

Independence from the client’s registration status in that region.

European countries specifically require compliance with fiscal and legal requirements based on registration status.

Our team came up with a solution that involved enhancing OneSource tax logic to accommodate user-entered tax amounts at the request level. This flexibility allowed OneSource to read the tax amount from the request, replacing the default tax response amount. By doing so, OneSource could return tax amounts aligned with business expectations, irrespective of VAT registration in the ship-to location. This tailored approach ensured accurate tax rates, even when our client lacked registration in certain regions.

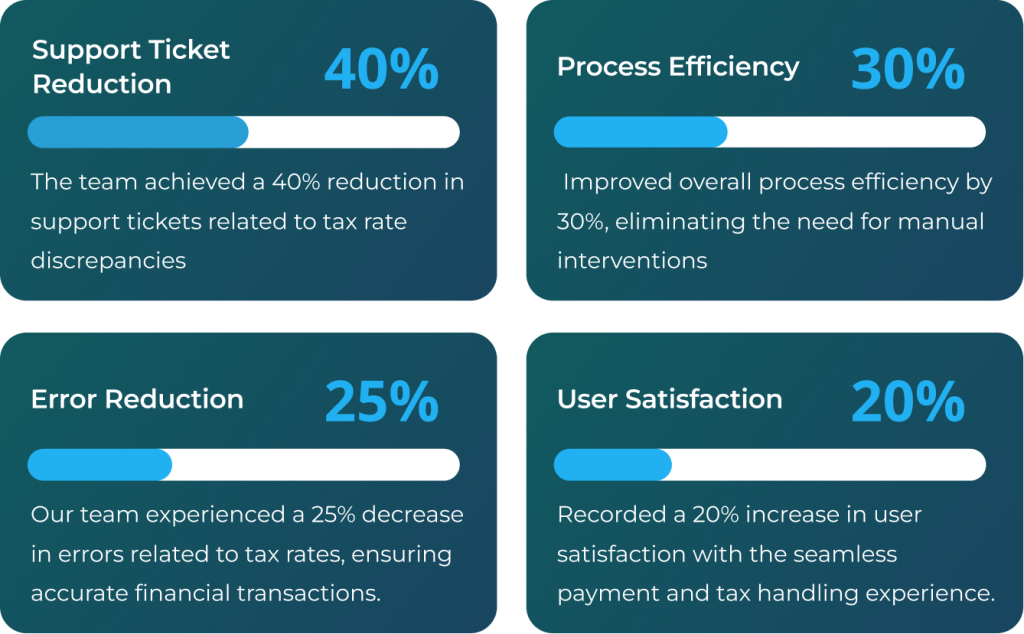

This strategic enhancement enabled our client to post documents with correct tax rates, eliminating the need for manual workarounds. Notably, it addressed issues stemming from a workaround solution that previously caused problems in various transactions. Our team found the result was a reduction in support tickets related to tax rate discrepancies, showcasing the efficacy of the permanent solution in streamlining business processes.

In conclusion, this case study illuminates the technical prowess behind our team’s integration of SAP S/4HANA and OneSource Indirect Tax Engine, resolving intricate challenges in indirect taxation logic. The success of this initiative underscores our client’s commitment to leveraging cutting-edge solutions for a seamless and efficient global financial operation.